Getting The Maryland Chapter 13 Bankruptcy Lawyers To Work

The Los Angeles Chapter 13 bankruptcy attorneys at Weintraub & Selth, APC, have answers to your questions about bankruptcy. We also can discuss the possible alternatives to bankruptcy which are suitable for your situation. Many of our clients reach out to us believing that bankruptcy is their only option. Often, because we have decades of experience, we are able to help many of them avoid bankruptcy.

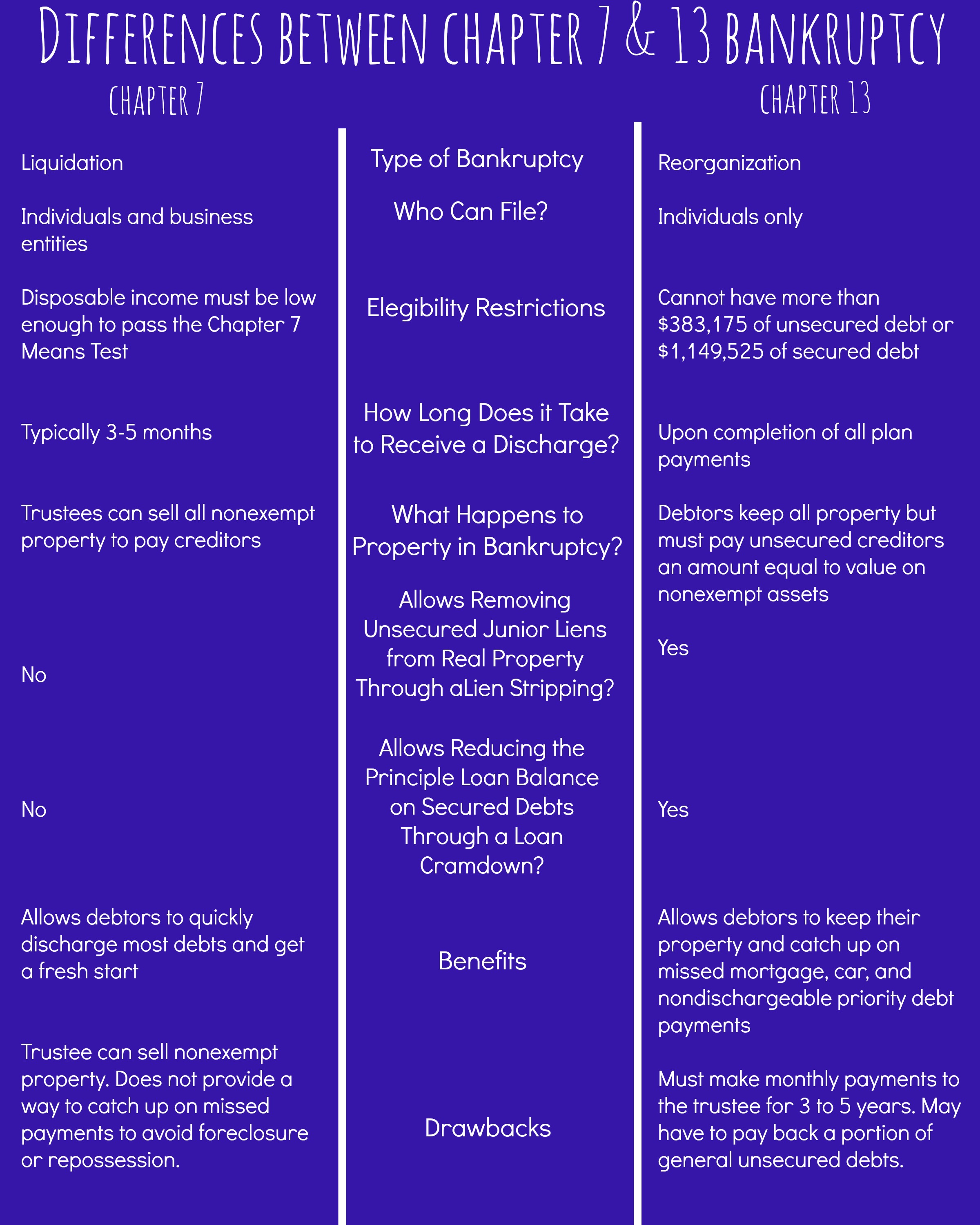

Chapter 13 can eliminate or reduce many types of debt including: Car loans Credit card debt Medical bills Tax debt Chapter 13 bankruptcy is the second most popular form of personal bankruptcy, second only to Chapter 7. Although the overall filings for Chapter 13 bankruptcy in California have fallen in recent years, it is still a valuable option.

If you are being pestered by debt collectors, as soon as we file your case, such harassment will stop and you will begin the road to financial stability. For answers to your questions about Chapter 13 bankruptcy, call (310) 584-7702 or (877) 716-7285. Our bankruptcy attorneys will defend your assets and be your advocates through the bankruptcy process.

The Best Strategy To Use For Maryland Chapter 13 Bankruptcy Lawyers

Chapter 13 may be ideal for: individuals who have fallen behind on mortgage payments individuals who need time to repay taxes people who want to protect their homes from foreclosure consumers who are being crushed beneath the burden of credit card debt with enormous interest rates and huge late payment penalties - chapter 13 bankruptcy lawyers in md.

Our Chapter 13 bankruptcy attorneys handle all types of bankruptcy and we will help determine which path is best for you.Our Chapter 13 bankruptcy attorneys are committed to delivering aggressive and creative debt solutions at affordable fees. We have developed an innovative fee structure that allows us to bundle legal services for a flat or monthly fee.

Call us now to determine how we can help you. “I hired Jim to help me file Bankruptcy. With just a single fee, Jim help me with this case for almost 3 years - chapter 13 bankruptcy lawyers baltimore MD. I requested delays for many reasons. The most important of which was to not decrease my chances of renegotiating the loan on my condo.

The 6-Second Trick For Maryland Chapter 13 Bankruptcy Lawyers

Jim went above and beyond what most attorneys would have done. Although this was a very difficult time in my life, the upside is I met someone that I consider a good friend.†-Michael .

Bankruptcy is an overwhelming process. A debtor may wonder “What assets can I keep?†and “What is the quickest and most painless way for me to satisfy my debts?†When scouring the Internet to find answers to these questions, many self-help websites boldly proclaim, “KEEP YOUR VALUABLE PROPERTY WITH CHAPTER 13!†and “CHAPTER 13 WORKED FOR HIM & WILL WORK FOR YOU!†Lawyers have commented that Chapter 13 bankruptcy is “innovative†in its approach and “extremely attractive.†When first enacted, Congress envisioned Chapter 13 as a method to provide “great self-satisfaction and pride to those debtors who complete them and at the same time effect a maximum return to creditors.†What is it and how does it work? In a Chapter 13 bankruptcy plan, the debtor proposes a repayment and reorganization plan to the bankruptcy court.

The procedure of formulating a plan and getting it approved is covered by another presentation. Once a plan is approved, the proceeding enters the repayment period phase, as the debtor makes payments called for by the approved plan.During the repayment period, creditors are not permitted to harass the debtor to collect their debts; they are only entitled to payments under to the plan.

Little Known Questions About Maryland Chapter 13 Bankruptcy Lawyers.

In a Chapter 7, a debtor must surrender her nonexempt assets to pay off her creditors, examples of which may include a vacation home, valuable artwork and jewelry. Along with flexibility, Chapter 13 bankruptcy allows for the discharge, or elimination, of debts, even more so than under Chapter 7. For example, debts dischargeable under Chapter 13, but not Chapter 7, include:· Debts arising from property settlements in divorce proceedings;· Debts incurred to pay non-dischargeable tax obligations; and · Debts for malicious injury to property There are several eligibility requirements for Chapter 13 bankruptcy.

Only individuals and those filing jointly as a husband and wife can do so. Maryland chapter 13 bankruptcy lawyers. Though business owners cannot file under Chapter 13 in the name of the businesses, individual owners as sole proprietors can file for debts for which they are personally liable. Second, the debtor’s secured debts cannot exceed $1,184,200 and her unsecured debts cannot exceed $394,725 (both numbers as of 2017).

Most debts are unsecured, as they are not tied to any assets. Examples of unsecured debts include credit card debts, medical bills, and legal bills. Third, a debtor must show that in the preceding 180 days, a prior bankruptcy petition was not dismissed due to failure to appear before the court or failure to comply with bankruptcy court orders.

Cheap Chapter 13 Bankruptcy Lawyers Md - An Overview

Fifth, a debtor will have to fulfill a credit counseling requirement during the 180-day period before filing the bankruptcy petition. The counseling may take place over the Internet or in-person, but the debtor must receive credit counseling from an approved credit counseling agency either in an individual or group briefing and she must provide the bankruptcy court with a certificate of proof to establish that she has undergone this counseling (Maryland chapter 13 bankruptcy lawyers).

If there is an emergency or if the bankruptcy trustee has determined that there are an insufficient number of approved agencies to provide the required counseling, she may forego this requirement. Though Chapter 13 has its advantages, the requirement of following through with a 5-year payment plan can sometimes be difficult.

chapter 13 dismissal chapter 7 bankruptcy attorney near me canton bankruptcy attorney